A continuation of the analysis of the current situation in Illinois by WirePoints:

Fact 4

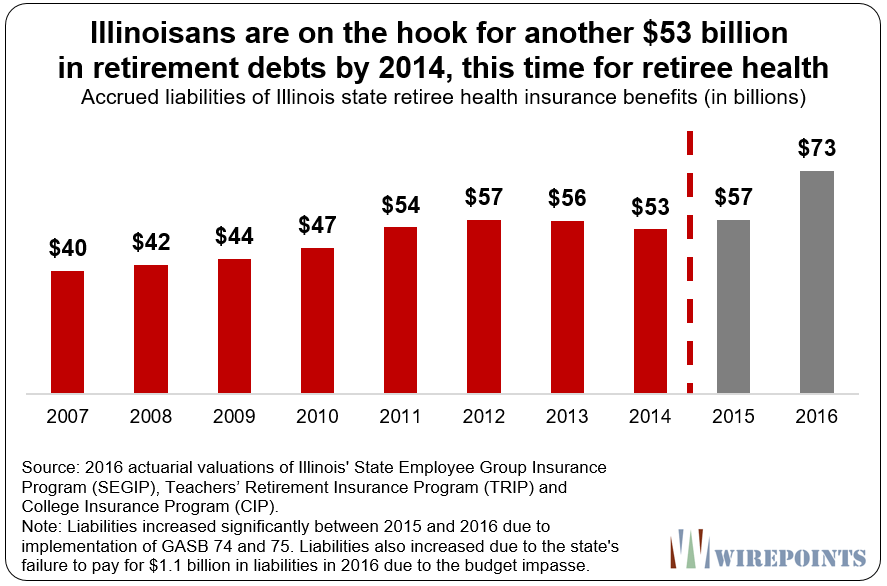

4. Retiree health insurance debts. Illinois politicians racked another debt over the past few decades by offering state workers free health insurance in retirement. By 2014, the total value of that perk exceeded $53 billion and yet politicians had set aside nothing for this debt. The entire debt is unfunded. (New accounting rules implemented in 2016 pushed up the value of the perk for state workers to $73 billion.)

And age eligibility for these programs is earlier than Medicaire.

Are these numbers on top of the 130 billion pension debt or included in it?

Are these numbers the cost of insurance spread over the remaining lifetime of the recipient? $

50 bn spread over 20 or 30 years is very different from $50 bn due now.

This seems like a scare tactic.

Retiree health insurance benefits are on top of the $130B pension debt.

Two different categories.

So roughly, $130B + $72B = $203B.

This is a very big problem.

Illinois is an outlier compared to other states in this area.

Retiree healthcare falls under Other Post Employment Benefits (OPEB).

+++++

The state pensions are TRS, SERS, SURS, GARS, & JRS.

The state retiree healthcare programs are TRIP, SEGIP, and CIP.

+++++

The Illinois (state) Supreme Court has ruled that state pensions and retiree healthcare for public sector workers cannot be diminished or impaired.

Meaning the sentence approved by voters on December 15, 1970 as part of the constitutional rewrite applies not only to pensions, but also to retiree healthcare.

The sentence is:

“Membership in any pension or retirement system of the State,

any unit of local government or school district,

or any agency or instrumentality thereof,

shall be an enforceable contractual relationship,

the benefits of which shall not be diminished or impaired.”

++++++++++

Thus if a new law is enacted to reduce pension or retiree healthcare benefits for public sector workers in Illinois, the changes apply only to future workers.

Not to anyone employed up until the law takes effect.

This has happened.

For example, Tier 1 pension benefits apply to those beginning their employment prior to January 1, 2011.

Tier II pension benefits apply to those beginning their employment on or after January 1, 2011.

++++++++

The voters had no clue of the consequences of the sentence that was approved on December 15, 1970.

Some major drawback of the sentence being:

– Pension benefits can be hiked through the lawmaking process by State Reps, State Senators, and Governors, even if the pensions are already underfunded.

– Salaries can be hiked if pensions are already underfunded.

– The hikes cannot be rescinded if they are unaffordable for current workers, only for future workers.

Time value of money is lost on you people

$53B in 2014, $57B in 2015, $73B in 2016, etc. is the amount that actuaries estimate should be in the fund now to payout in the future.

This is explained in the link in the article.

++++++++

An unfunded liability is the amount that actuaries calculate should be in the fund now, to make payouts in the future, be they pensions or retiree healthcare.

++++++++

Much easier to pass legislation hiking benefits, than it is to fund the hikes.

Just as it is much easier to charge an item to a credit card, than it is to fund the purchase.

++++++++

A big problem with credit card balances that are not paid off monthly, and with unfunded pension and retiree healthcare liabilities, is interest.

The time value of money does apply to unfunded liabilities.

Importantly, the investment return on zero principal is guaranteed to be zero.

The unfunded liability consists of principal and interest.

Just as an unpaid credit card balance consists of principal and interest.

The unfunded liability, in other words, is the amount that should be invested now, so that investment returns can be realized, to make future payments of principal and interest in the future.

With Illinois public sector pensions and retiree healthcare, the taxpayer is responsible for 100% of the unfunded liability.

The employee and retiree is responsible for zero as an employee.

Obviously employees and retirees are responsible as taxpayers, but the value of the pension and retiree healthcare payout is usually bigger than taxes paid.

An exception might be someone who only worked a few years as a public sector employee.

It’s not just a mess, it’s a hot mess!