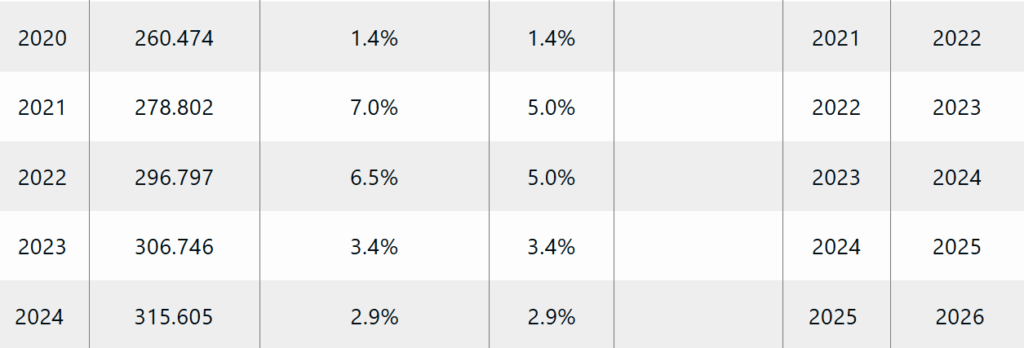

With the Consumer Price Index having been announced by the Federal government, the Illinois Department of Revenue has announced that non-Home Rule local governments (including schools) are limited to a 2.9% increase in the tax levies they pass this year.

The limit is on property tax bills to be paid in 2026.

The figures from recent years for what the tax folks call “PTELL” or what ordinary folk call the “Tax Cap” folllow: