From rural Woodstock resident Susan Handelsman:

End of Tax Increment Financing District Not a “Bonus”

It is disheartening to read expiring TIF EAV is a “bonus”, according to Woodstock Independent editor.

Woodstock has suffered crushing property tax rates (ranging from 2.9% to 4.6% over past decade.

The Woodstock rate is triple to quadruple the national average).*

As a result, Woodstock has suffered depressed property values, and no meaningful property development, since the 2008 crash.

In this same time period the rest of America enjoyed a boom in both new construction and price appreciation.

No rational developer would invest in property in a taxing district taking ~3.5% of full fair market value, when all over America and Illinois there are development opportunities within communities maintaining supportable property tax rates of 1%-2%.

Therefore, Woodstock City rulers promoted TIF subsidies to encourage development.

These TIF gave recipients money and free property and other assets belonging to taxpayers, including bonded debt for which taxpayers had ultimate responsibility.

Furthermore, TIF obligates taxpayers to millions of dollars of tax dollar subsidies over subsequent 35 years or longer, in order to pay for TIF freeriders’ mandated social services (schools, roads, library, police, fire & rescue, conservation, parks, community college, government).

TIF is only allowed to spend the money it collects on TIF-region building and infrastructure improvements, and fees to City-picked attorneys and consultants.

Take a moment to look at Woodstock City government.

Do those who voted for TIF own property or businesses within TIF footprint?

This observation is meant not to accuse, but to illustrate to taxpayers that some do benefit economically from taking tax subsidies from those unlucky property owners who are outside the TIF boundaries.

The assessed values of Woodstock real estate within TIF boundaries has suffered less than the real estate values outside TIF.

To get a grasp on the new TIF tax burden to taxpayers, consider Woodstock TIF2.

The current p-tax burden per new pupil in Woodstock D200 is $10,000 in 2020.

That is: Tax levy divided by enrollment.

Nearly all of that will necessarily be borne by non-TIF Woodstock taxpayers.

That total new cost burden can be estimated by formula: Residential units contain 2.6 individuals.

The percentage of school aged children (defined as ages with legal entitlements to free public education services) is around 23%.

That means that for each new residential unit there will be 0.60 new enrollment expected. There are over 1200 new residential units planned or in progress via Woodstock TIF 2.

That equates to 720 new student enrollments.

At (2020) $10,000 annual cost to taxpayers per pupil (that is, annual levy divided by enrollment, steadily rising in past decade from $8000/year to current $10,000/year).

That adds $7.2 million per year annual tax burden to non-TIF taxpayers.

And that is just the first year!

Remember, Woodstock D200 raises its OEPP and levy such that the tax-burden-per-pupil rises annually with inflation.(NOTE: $10,000 is NOT the entire amount spent per pupil, this is the amount Property-Taxed per pupil in 2019).

TIF new EAV is not a “bonus”.

It was paid for in uninflated dollars taxed of past 23 years, year after year, by non-TIF taxpayers. It has been the partial cause of all homes in Woodstock being worth less and less every year relative to inflation and relative to homes all over America (including Chicago).

Woodstock equalized assessed value could have been higher today, and the economy less distressed, without TIF.

TIF takes a high property tax rate and makes it higher.

TIF forces Woodstock household budgets to cut discretionary spending in order to pay ever higher property taxes, so local economy suffers.

TIF and the profligate spending which engendered TIF have made Woodstock one of the highest property tax rate regions in all of America , and ruined any hopes of economic recovery from the 2008 crash.

Here is the PROOF:

Woodstock D200 EAV (that is, equalized assessed value, which is equal to 1/3 of the full assessed taxable value of real estate within Woodstock D200 taxing district) was at its peak in 2009 assessment year: $1,128,047,545. 2009 Residential EAV was $896,915,891.

Shouldn’t Woodstock property values be higher today than 2008 pre-crash, after America’s booming economic recovery , plus a decade of monetary inflation?

By comparison, America’s Case Shiller home price index is up 22%-44% from 2008 pre-crash highs.( Case-Shiller Pre-crash peak around 2007 of 180, post-crash lows just below 140 around 2012. After economic recovery, recent high of 220 reached in 2020, now skyrocketing to 260 in 2021.)

Woodstock 2020 EAV is $900,816,134.

That is (-20%) twenty percent BELOW pre-crash valuations.

While America’s home values have RISEN 22%-44% from pre-crash highs, Woodstock’s home and property values have FALLEN 20%. (Woodstock Residential values fell even MORE from pre-crash high of 2009 $896,915,891 to 2020 $692,685,205; this represents a DROP in residential property values of 22.7% from pre-crash highs).

Again: while America has prospered, Woodstock assessed property values have FALLEN more than -(20%) BELOW 2008 peak assessed values.

That property value depreciation is evidence what TIF does to a community. Does that sound anything like a “bonus” to YOU?

*In America, property tax rates averaged around 1% over the time period 2006-2019. In Chicago, rates were below 2% A home in Woodstock paid3.6% property tax rates in 2020. In 2019: 3.7%, 2018 3.7%, 2017 3.9%, 2016 3.9%, 2015 4.5%, 2014 4.6%, 2013 4.3%, 2012 3.8%, 2011 3.3%, 2010 2.9%, 2009 2.7%, 2008 2.7%, 2007 2.6%, 2006 2.6%.

A damn outrage. Sager is one of the pushers.

Good read Susan.

You forced me to go to the interactive map and look at my village which has no TIF areas.

They really have route 47 locked down for “conservation land” according to that interactive map.

It opened my eyes on why you are so vocal and versed on this topic.

jt, there is an argument for legal action against TIF promoters within municipalities who drain subsidies from property owners outside municipalities: “taxation without representation”.

Those in unincorporated areas, as well as Bull Valley, do not have right to vote for Woodstock City government.

Yet Woodstock City government has had the rights to impose massive destructive tax burdens onto property owners who are obligated to pay into the Woodstock D200 school district, and other overlapping taxing districts.

Woodstock City can create the need for these tax burdens, and Woodstock City government may personally profit from the infliction of these tax burdens, but those who are obligated for these tax burdens are disenfranchised: have no vote on whether these tax burdens may be imposed.

And as pointed out above, these tax burdens are not trivial.

In addition to obvious burdens described above, Woodstock D200 is building up a massive OPEB debt burden, due to massive hiring for benefit of ‘freerider’ student enrollment.

Tax burdens have always equated to lower property values, as evidenced in data above.

The creation and destruction of the Lakewood TIF is a fascinating history.

Lakewood was able to create a TIF in annexed territory within Woodstock D200 taxing district.

All the new low income housing students from that TIF would be sent to Woodstock D200, for 35 years, almost 100% at Woodstock D200 taxpayer expense.

At the same time, all TIF tax money would benefit Lakewood coffers.

Note that Village of Lakewood government was empowered to burden disenfranchised taxpayers outside Lakewood with multimillions of dollars of annual taxation obligation.

A few concerned citizens got involved.

D200 Admin and School Board at the time declined to legally object to the Lakewood TIF.

It was pointed out that D200 gets their money either way, so why should they care who has to pay their levy?

A suggestion was made that Lakewood could “detach and annex” that TIF area into Crystal Lake school districts…that was where all Lakewood “East” property tax dollars were sent.

Lakewood and Crystal Lake school district property taxpayers did not fancy that idea.

There was a closed-door meeting between D200 school board president at the time, and Lakewood president at the time.

There was a document crafted, a so-called PILOT (Payments in lieu of taxation) agreement.

(Notably current Woodstock D200 president Carl Gilmore who was then a school board member spoke against the agreement, calling it unenforceable. Gilmore is a licensed attorney at the time as now).

The amount of money which was charged in property taxes PER STUDENT was astounding to some people at the time.

Lakewood people objected.

A new Lakewood Pres was elected on a write-in vote.

TIF was dismantled.

Lakewood remains in defiance of Illinois Fair Housing law which requires a percentage of ‘affordable housing’.

TIF remains a threat to every property owner.

Self defense requires concerned citizens willing to act.

I’m beginning to understand better the source of your ire Susan.

As I read I was thinking Lakewood is always Crystal Lake which it is since village boundaries end south of 176.

Those kids shouldn’t be in Woodstock.

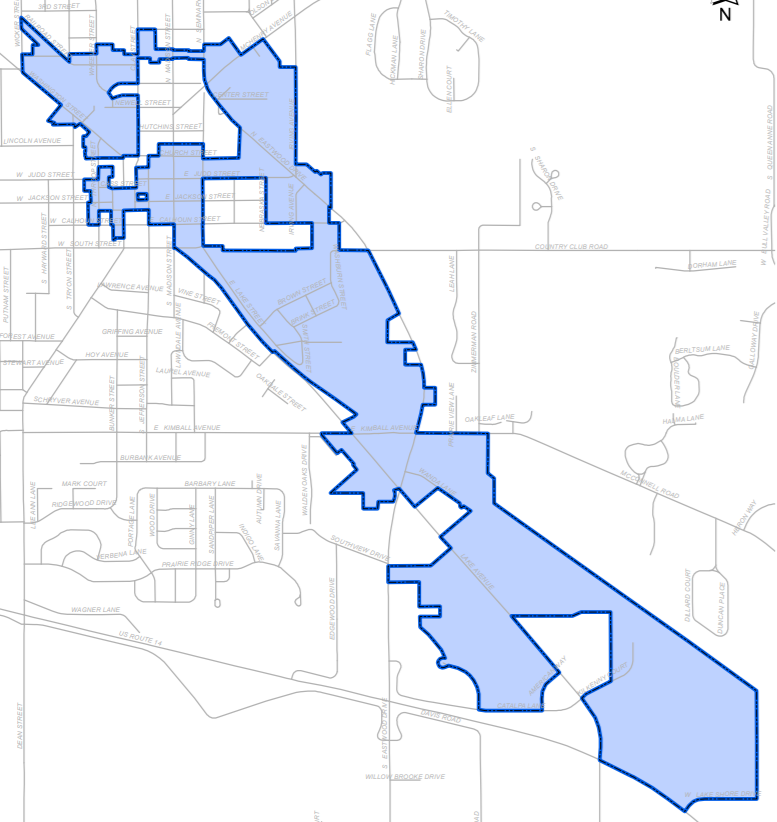

Then I look at the Woodstock Community Unit School District 200 map and am dumbfounded.

You are likely teaching me even more so thanks.

Who would draw a school district map for Woodstock that encompasses properties south of 176?

I also see the TIF Lakemoor created amazingly right near that sliver south of 176.

So whoever drew the WCUSD 200 map and the people who approved that TIF for Lakemoor knew exactly what they were doing.

Passing their taxpayer burden onto you and other Woodstock residents.

Can you petition Woodstock to change the boundaries of the WCUSD?

This would allow you to bypass Lakemoor altogether and reduce your burden.

They would sue but Woodstock could sue back for pushing tax burdens from Lakemoor onto you?

I know you’re a lady but you are in the middle of a clusterf..k.

If you have any more details to share please do.

I looked into detachment/annexation process.

Takes work.

Nobody else seems willing to make any effort.

Also, legal fees expensive.

Should I alone pay for the litigation to benefit all d200 taxpayers?

I assumed d200 will probably fight redistricting.

The admin is rewarded by higher enrollment headcount.

They would presumably fight any action which reduces their possible enrollment.and they have gobs of taxpayer money to pay lawyers to fight.