From the Illilnois Department of Revenue:

CPI Change for 2022 Extensions (for property taxes payable in 2023) for Taxing Districts Subject to PTELL

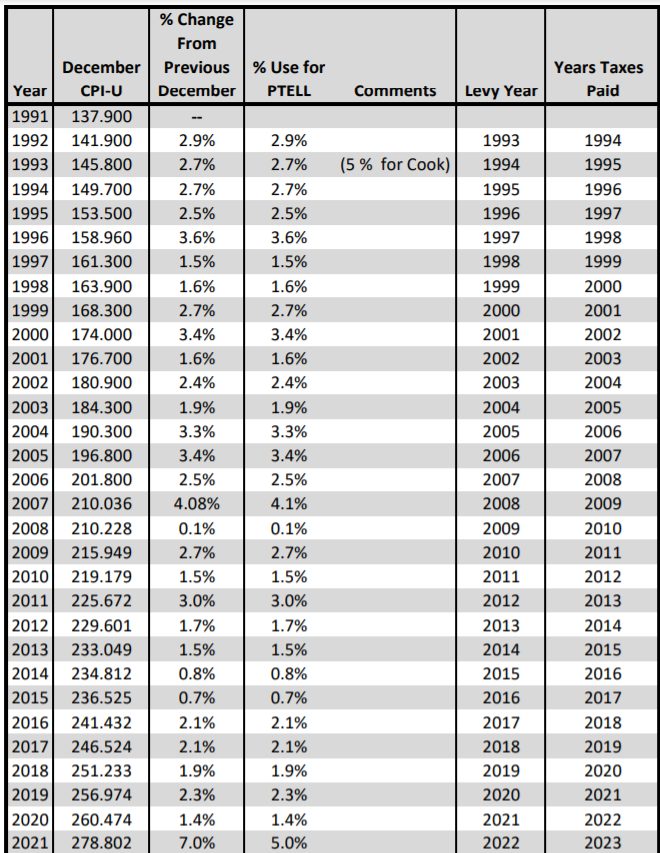

The Consumer Price Index (CPI) “cost of living” or inflation percentage to use in computing the 2022 extensions (taxes payable in 2023) under PTELL is 5.0%. [Emphasis added.]

Section 18-185 of the Property Tax Code defines CPI as “the Consumer Price Index for All Urban Consumers for all items published by the United States Department of Labor.” This index is sometimes referred to as CPI-U.

Section 18-185 defines “extension limitation” and “debt service extension base” as “…the lesser of 5% or the percentage increase in the Consumer Price Index during the 12-month calendar year preceding the levy year…”

(emphasis added).

For 2022 extensions (taxes payable in 2023), the CPI to be used for computing the extension limitation and debt service extension base is 5.0%. The CPI is measured from December 2020 to December 2021. The U.S. City Average CPI for December 2020 was 260.474 and 278.802 for December 2021.

The CPI change is calculated by subtracting the 2020 CPI from the 2021 CPI. The amount is then divided by the 2020 CPI which results in 7.0% CPI. (278.802 – 260.474)/260.474 = 7.0%.

The Statute indicates the lesser of 5% or the actual percentage increase, in this case 5% is the lesser amount.

Information on PTELL may be accessed through the department’s web site at www.tax.illinois.gov under the “Property Tax” link and the “Property Tax Extension Limitation Law (PTELL)” link under the “General Information and Resources” heading.

= = = = =

One can see that hitting the five percent ceiling has not happened before in the three decade history ot the Property Tax Cap:

The bill former Governor Jim Edgar fought so hard to achieve–and did so while Mike Madigan was House Speaker–limits tax hikes to 1.4% in this year and, despite the 7% inflation brought on by Federal spending and Covid supply restrictions, will be capped at 5% in 2023.

Expect legislative attempts to raise the ceiling.

These are the seeds of revolution.

Approx 70 percent of our real estate tax bills are for school districts. Fantasy – would like to see headlines whereby school districts are cutting their overall costs by a certain percent every year for the next 10 years however that might be. Cutting salaries, benefits, pensions, frills, redundant administration positions, slightly larger classes, consolidation, etc.

Don’t townships have that limitation!?

Townships do.