Today, the McHJenry County Board is scheduled to vote on whether to recommend an extension of the 23-year Water’s Edge Tax Increment Financing District for another twelve years.

From Crystal Lake engineer Donald Kountz comes this analysis:

I’m going to restate the issue so I make sure I understand it and use it to bound my statements.

The City of McHenry has an existing TIF district and it is reaching the end of its 23 year life.

My understanding of the TIF Act means the extension has to be granted/approved by the Illinois Legislature in Springfield.

If the TIF extension is approved then it will be for an additional 12 years.

With a TIF extension does the EAV get a step up value and then get frozen again or does it retain the value from 23 years ago?

Does the existing TIF have outstanding bonds that won’t be repaid before the end of the TIF life?

What are they going to do over the next 12 years to complete the purpose of the TIF district?

While I’ve read the Act I did not focus on TIF extensions.

Does the existing TIF document have to be updated or does a new one need to be written?

Who wrote the original document for the City of McHenry?

Looking back and analyzing what I did right and wrong I believe the affected government taxing districts do NOT understand the importance and strength of their input into this document.

For the Water’s Edge TIF, Teska Associates wrote the document for the Committee of affected Taxing Districts and said there were no impacts to each of the government taxing districts.

None of them objected nor said that was wrong.

I wonder how many even read the document besides me.

I know one professional from School District 47 did as she pointed out a number of mistakes Teska made.

There were even more that I pointed out in my formal letter objecting to the establishment of the TIF District.

I went and did a 23 year look back, if the TIF had just ended and can share the following.

Looking back 23 years the cumulative rate of inflation was 77.8%.

In financial terms, tax revenue of $100,000 in 1999 would remain $100,000 today but the inflated expenses would be $177,837.

This short fall was the responsibility of the taxpayers outside this TIF district.

In real terms it means this commercial development did not pay for the increases in

- labor costs,

- pension costs,

- utility costs,

- transportation costs,

- insurance costs and

- capital replacement costs

for almost a quarter century.

This would repeat for another 12 years.

It’s easier to look back than forward. I don’t have the tools to do a 100/1,000/10,000 run Monte Carlo analysis.

Since I have detailed Water’s Edge TIF analysis consider the following.

This EAV is frozen at $3,333,192 and I use Teska’s stated EAV in 2022 dollars of $30M at completion.

I break the development into four phases.

No increase in EAV for the first three years during the tear down and construction of Rental Units, then increases to $10M in years four to six, increase to $20M in years seven to 10 as the commercial development finishes and reaches $30M in years 11-23 as the townhomes complete.

The County of McHenry’s levy remains at 0.736456 in the 23 years the County of McHenry will lose $33,428,697 not counting for inflation.

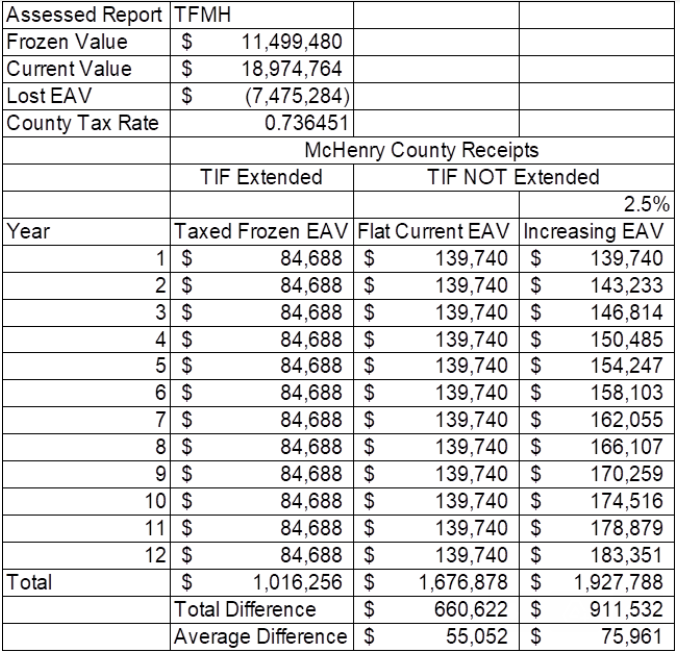

Any calculations are only as good as the input values. Please check my values: Frozen EAV ~$11.5M, current EAV ~$19M. I would need a future EAV growth either by year or by brackets (this is a guess) over the next 12 years. It’s easier to do calculations in current year dollars or someone will have to specify a yearly inflation rate. Over the last 23 years it was about 2.5% year over year.

Here is a very quick look from the Assessor’s April 2022 report using the TFMH Taxing District. I assumed growth at 2.5.

If this TIF is not extended and the EAV doesn’t increase in the next 12 years the county will get an additional $660k in total revenue or about $55k a year.

If the EAV increases 2.5% per year over 12 years the county will get an additional $911k total revenue or an average of $76k a year.