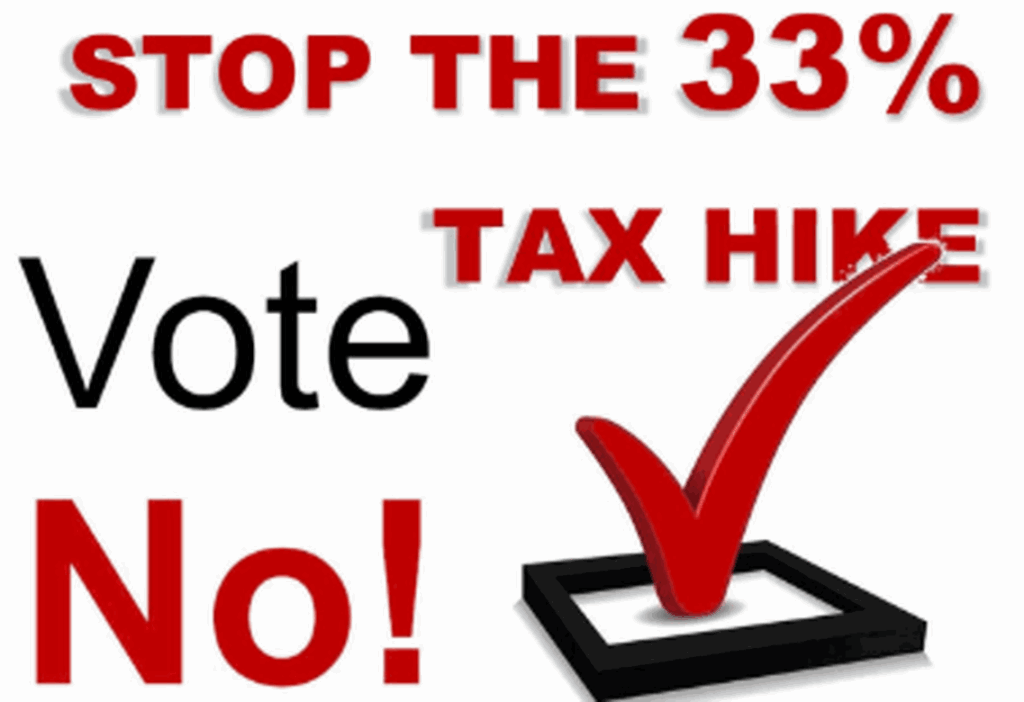

Stop McHenry County Conservation District from Gutting Tax Cap

By CAL SKINNER

The McHenry County Conservation District has a scheme to raise your taxes forever. And their scheme comes at a time when taxpayers should be seeing some relief.

The scheme goes like this: MCCD has bonds which are about to be paid off. When such borrowed money is repaid, tax bills automatically go down. At least, that’s the relief taxpayers expect to see.

But MCCD wants taxpayers to take a pass on their due taxbreaks. Instead, the Conservation District wants taxpayers to continue the payments into perpetuity.

They are counting on voters to agree to gut the Tax Cap by asking voters to continue making payments on an expense taxpayers have already paid off. The continued payments would be used for salaries and operating expenses.

MCCD is placing the following question as a referendum on the upcoming ballot:

Shall the limiting rate under the Property Tax Extension Limitation Law for the McHenry ,District Conservation District, McHenry County, Illinois, be increased by an addition amount equal to an 0.027% above the limiting rate for levy year 2023 for purpose of protecting drinking water sources protecting the water quality of rivers, lakes and streams, providing park access for people with disabilities, and ,lakes, protecting wildlife habitat, protecting forests and planting trees, approving and maintaining existing conservation conservation areas, and other lawful purposes of the Conservation District and be equal to 0.109660% of the equalized assessed value of the taxable property therein for the levy year 2024?

= = = = =

That’s a 33% tax rate increse!

(1) The approximate amount of taxes extended limiting rate is $9,250,889, and the approximate amount of taxes extendable if the proposition is approved is $12,272,592.

(2) For the 2024 levy year the approximate amount of the additional tax extendable against property containing a single family residence and having a fair market value of $100,000 at the time of the referendum is estimated to be $9.

= = = = =

Anyone own a home worth $100,000?

= = = = =

(3) If the proposition is approved, the aggregate extension for 2024 will be determined by the limiting rate set forth in the proposition, rather than the otherwise applicable limiting rate calculated under the provisions of the Property Tax Limitation Law (commonly known as The Property Tax Cap Law).

The purpose of this language is to allow the Conservation District to get more taxes than the Tax Cap allows.

Under the Tax Cap, a taxing district is only allowed to increase the amount it can pull out of our checkbooks by the increase in the national Consumer Price Index or CPI.

If the CPI is above 5%, as it was when it reached 7% in 2021 and 6.5% in 2022, state law “only” allows an increase of 5% in tax levies.

As homeowners getting tax bills know, most tax districts “taxed to the max.”

The Conservation Districts is asking voters to increase its operating tax rate by 33%.

That is a huge PERMANENT tax increase.

Voters have very few opportunities to cut their taxes. This is one of them. But it requires voters to show up and vote ‘No’ on the MCCD referendum.