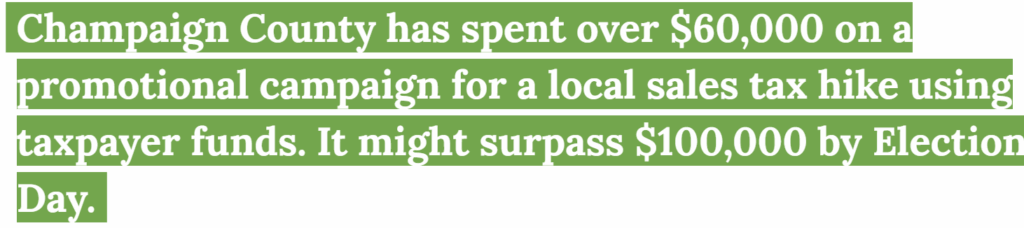

Illinois Policy has an article in which State Rep. Carol Ammons, a local Democrat, criticizes her County Board for spending tax dollars to promote a quarter of one percent sales tax.

The Conservation District has sent out a six by eight and a half inch postcard telling the good things passage of its tax hike referendum would bring. (“Protect WATER QUUALITY, Preserve WILDLIFE HABITAT, Improve OUTDOOR RECREATION ACCESS FOR ALL”).

There was no mention of how high the permanent operating rate tax hike will be.

One cannot find 33% anywhere in the mailing.

And no mention that it could be used for salary increases.

I have filed a Freedom of Information request for the cost, but have not yet received the MCCD’s response.

The McHenry County Conservation District is doing pretty much the same thing as the Champaign County Board.

The postcard does everything to paint a rosy picture except use the forbidden words “Vote Yes.”

But it gets worse.

There is a “Vote Yes for the Conservation District Proposition PAC” financed with $50,000 from $1 million of principal that should have gone to the Conservation District rather than (according to a Federal court order) to a “to be formed foundation'”

The “Vote Yes for the McHenry County Conservation District Proposition” committee has in the range of $60,000 in cash for promotion, plus two staffers contributed by conservation groups in Chicago.

That was on top of over $100,000 sitting ina bank acocunt at mid-year.

So far two malings have arrived urging favorable votes, plus the one from the MCCD saying pretty much the same thing, but not including the words “Vote Yes.”

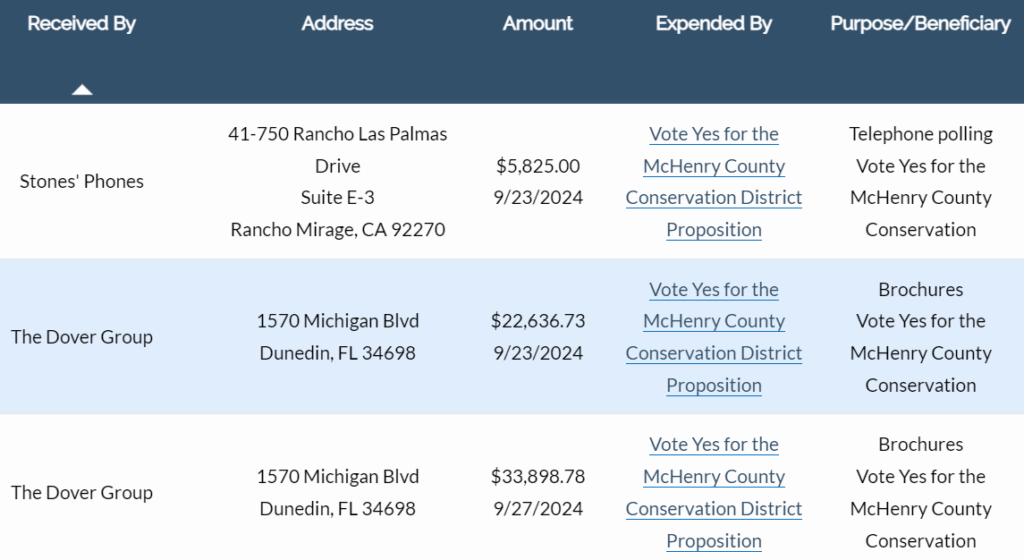

Here is what was spent:

I’ve spent three weekends (with the help of local Libertarian party members) repurposing old signs to say “Vote No,”

Sweat equity on the part of the opponents versus real money for the propoents.

Also found a box of “Vote No on the Tax Referendum” yard signs hidden for a long time in my garage.

The local GOP came out against the referendum but there has been no article about that in the Northwest Herald..

The Republlicn Party has printed up some 4 by 4’s and yard signs with the same message.

Libertsriana have printed up yard signs as well.

It is a completely unbalanced campaign.

Sweat equity versus $78,000 spent through the end of Septmeber.

What has steam coming off the top of my head is the source of $50,000 of the proponents’ financing.

Back in the mid-1990’s Lakehead Pipeline sought eminent domain permission from the Illinois Commerce Commision. Eminent domaine allows an entiry to grab property (usually for roads) and argue about the right price in court.

The proposed route went through State Rep. Ann Hughes’s husband’s seed corn acreage,and, more importantly, through the farm of the wife of a University of Chicago economist who won a Nobel Prize.

The economist wrote a brief to the ICC pointing out that, because the construction of the oil pipeline would not lower the price of gasoline even a penny, there was no public purpose for granting eminent domain power.

None was granted, so Lakehead had to pay market value. A pipeline map of McHenry County I once found showed lots of strange bends for Lakehead.

The last 50-60 feet needed was through a MCCD bike path between Huntley and Union.

Lakehead sued and in the resulting settlement in Federal court Lakehead ponied up $2 million.

Good negotiations, I’d say..

One million dollars went to the Conservation District.

The other million was designated for a “to be formed foundation,” which ended up being called the “McHenry County Conservation Foundation.”

I strongly believe the second million also should have ended up in the Conservstion District’s bank account.

Guess who ended up controlling the new Foundation.

It was the folks who were once on the Conservation District Board.

Come 2001 and MCCD put up a hefty referendum to buy land.

Four mailings came from the Foundation.

It sent me ballistic.

The answer to the stink I made was that the Foundation was not using the million from the late 1990’s settlement that I contend should have gone to the MCCD, but from the interest earned on that money.

I tracked down an IRS employee in the not-for-profit division who told me that two Federal court cases had allowed non-profits to spend in the range of 10% and 16% of their assets on lobbying each year and that the definition of “lobbying” included the support or opposition of referendums.

Come 2008 and another bond issue was put on the ballot.

The Foundation contributed over $19,000 for mailings and $20,000 for phone calls, the campaign disclosure says.

This time around, the Foundation has given $50,000 to the “Vote Yes” committee and national conservation groups paid for campaign workers.

So, it’s not the typical school bond referendum financing in which vendors kick in money (although one professional engineer did personally contribute $2,500).

The Vote Yes campaign has motivated my fervent opposition.

The most recently issued bonds will soon be paid off and, if nothing is passed, the MCCD tax rate will go down 60%.

Passage of the referendum will cut the total tax rate by 45%, but increase the district’s operating rate permanently by 33%.

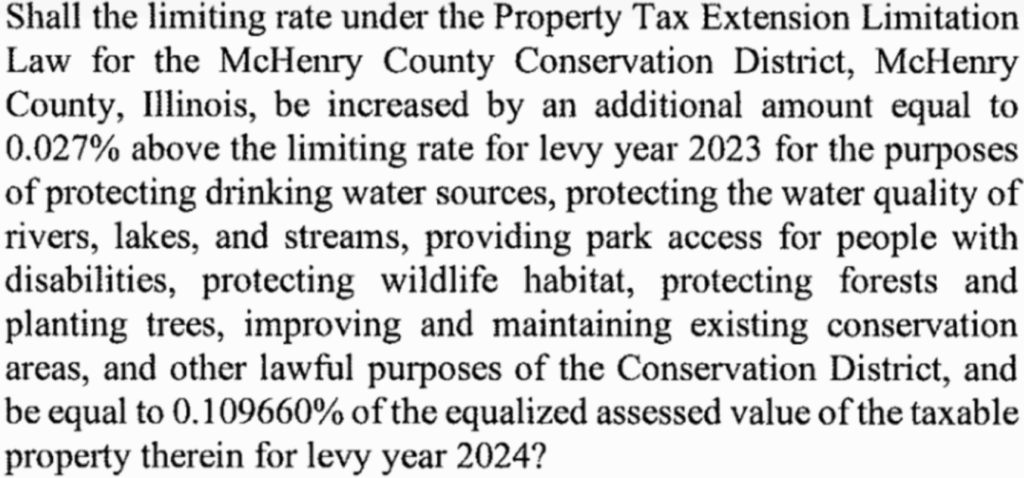

Hard to tell from the ballot because of extraneous information between the requested rate hike (.027 with three or four more digits that no one will understand) and the post-Tax Cap waivure rate of .109 with three or four more digits.

Underneath is the statement that for a “$100,000 home” the cost will be $9 a year. The average price of a home in McHenry County is $330,000+.

The ballot language can be found below

Can you figure out it’s a 33% operating tax rate hike from the ballot language?

Did you now that the aveage home in McHenry County is worth $330,000+, not $100,000?