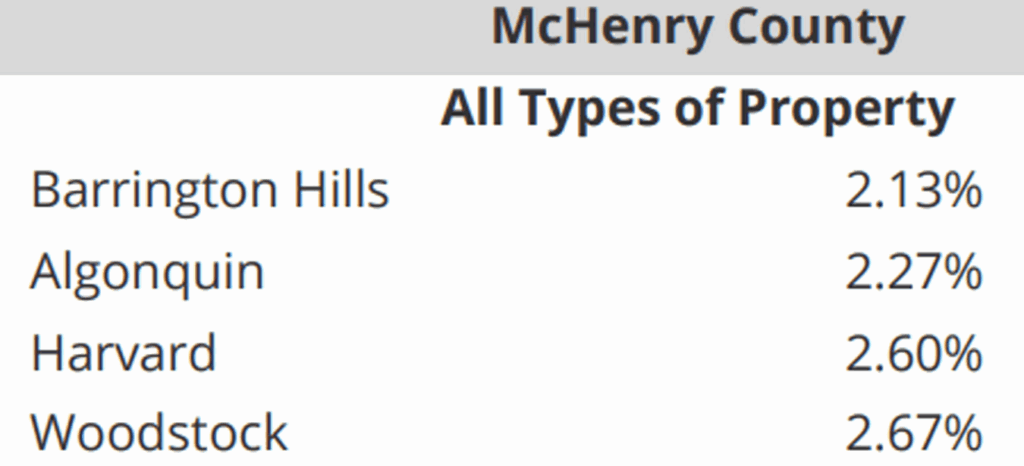

If you take your property tax bill and divide it by the value of your home, you get was is called an “effective tax rate.”

The Civic Federation puts out a report every year telling what the average effective tax rate is for selected cities.

Unfortunately, Crystal Lake, Huntley and McHenry do not make the cut.

The figures for Barrington Hills, Algonquin, Harvard ad Woodstock are below:

Homeowners in Chicago are only taxed 1.69% of their abodes’ value.