If past is prologue, the McHenry County Board will again decide not to minimize its property tax take in 2026.

I base that statement on the recommendations for those serving on the Finance Committee this term.

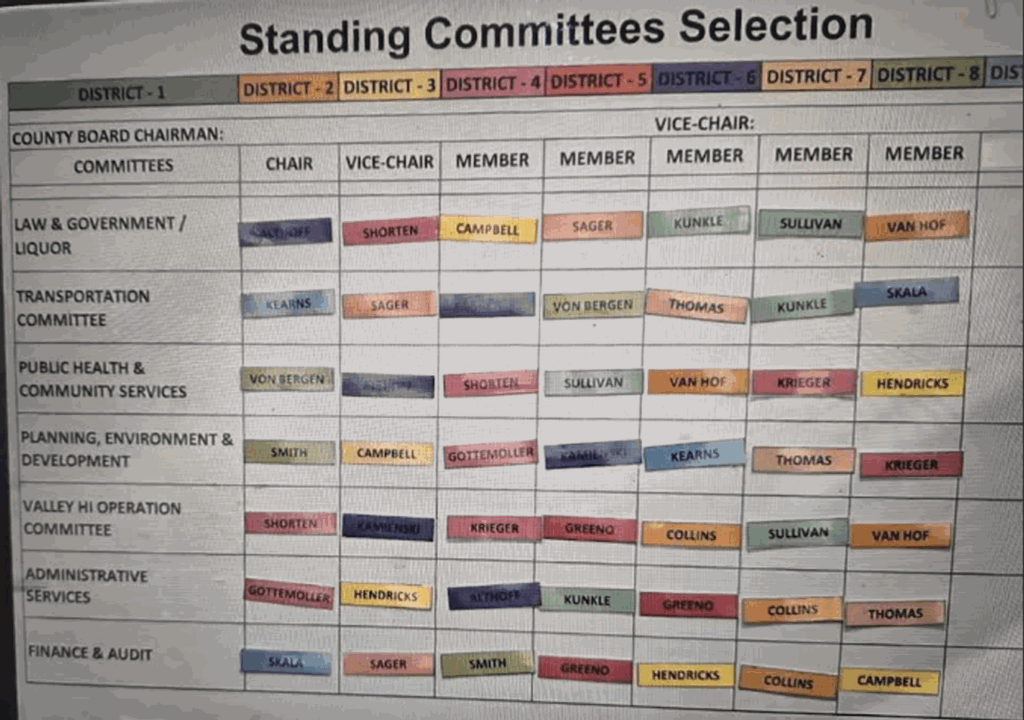

Those recommended to serve on the Finance Committee can be found on the bottom row in the chart below:

Chairman Mike Skala, Vice Chairman Brian Sager and members Larry Smith and Carolyn Campbell were all part of the coalition which refused to recommend a flat 2025 real estate tax levy. Add to that number re-tread John Collins, who voted for higher taxes in his previous appointed County Board membership, and those favorable to tax hikes outnumber those who aren’t by a margin of 5-2.

Terri Greeno led the fight to keep next spring’s tax bills flat. She was joined by Tax Hawk Erik Hendricks.

At the end of the meeting, Joe Gottemoller, Chairman of the Committee on Committees, said from his viewpoint as a former Chairman of the County Board, the only role of the Finance Committee was to present a budget that could be passed by the fill Board.

The procedure for at lease the last two years has been the Finance Committee’s presenting a tax levy in October, which is put on public view for thirty days. There is no option to amend the budget at the October meeting.

In November this year, Greeno led the effort to amend the tax levy so that only new assessment growth would be captured. She lost by the votes of three Democrats who are no longer on the Board.

So, it’s probable that fiscal conservatives have a majority on the new County Board.

That majority is not reflected in the composition of the Finance Committee.