From Crystal Lake’s Don Kountz::

Crystal Lake held their annual Tax Increment Financing (TIF) Joint Review Board and Public Hearing recently.

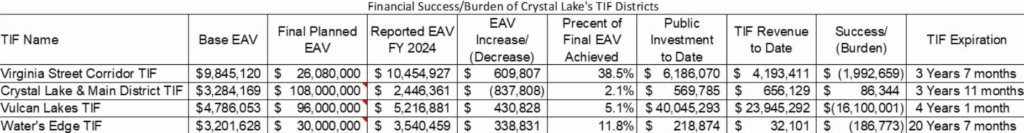

I’ve made a simple spreadsheet from the mandatory reports that are filed with the Illinois State Comptroller.

Items to note are three of Crystal Lake’s four TIFs will expire in less than 5 years.

It is too early to do an detailed analysis on the Water’s Edge.

Most of their $218,874 expenses are $177,157 in legal fees to Filippini Law firm.

An EAV is the Equalized Assessed Valuation of the property within the TIF district.

The EAV is one third the fair market value.

All the planned final EAVs were not only wrong but way wrong. (Em[hasis added.)Wildly

The Virginia Street Corridor TIF is almost 39% of plan with less than four year remaining.

The Crystal Lake & Main District TIF has a reported EAV of almost $2.5 million versus a plan of $108 million.

Vulcan Lakes TIF which is home to Crystal Lake’s Three Oaks Recreation Area has a reported EAV of $5.2 million versus a plan of $96 million.

Vulcan Lakes finical burden is compounded by over $40 million in public investment.

The report shows almost $24 million in TIF Revenue, however, this is the identification of the bonds Crystal Lake issued to pay for the public investment.

These bonds are being paid off with the ¾ precent additional sales tax Crystal Lake passed under its home rule authority and “Transfers from Municipal Sources”.