From the Illinois Policy Institute:

The Illinois Constitution currently requires income taxes to be imposed at a single, flat rate. A new bill [actually a Constitutional Amendment] filed in the Illinois General Assembly would allow for income to be taxed at varying rates, making it easier for lawmakers to raise rates.

A bill filed in the Illinois General Assembly would eliminate Illinois’ constitutional protection that requires when taxes are hiked, they be hiked on everyone so everyone can hold state lawmakers accountable.

The bill, Senate Joint Resolution Constitutional Amendment 04, introduced Feb. 5 by Sen. Robert Martwick, D-Chicago, would eliminate Illinois’ flat tax and allow a graduated, or progressive, income tax structure.

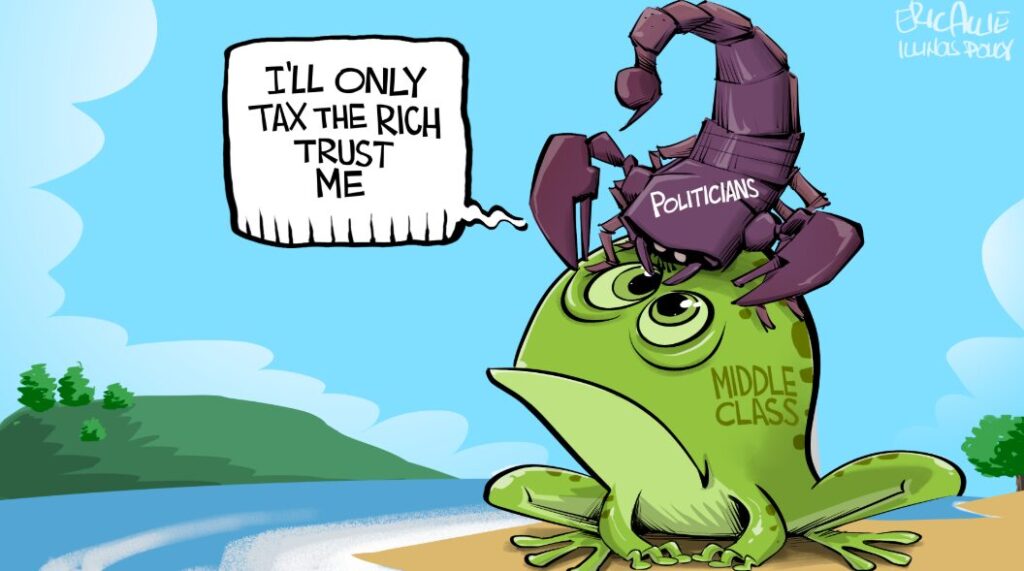

Progressive income taxes allow for income taxes to be imposed at varying rates that increase with higher levels of income, but the change would also let state lawmakers divide and conquer taxpayers without facing widespread ire during the next election.

Voters already rejected the idea in 2020. Despite Gov. J.B. Pritzker putting $58 million of his own money into the campaign, 55% of voters rejected his “Fair Tax” because of the potential to impose retirement taxes and let lawmakers easily set tax rates as they saw fit.

Lawmakers faced angry constituents after the 3% state income tax rate was raised in 2011 and again in 2017. They face a political cost when they raise income taxes. The rate is now 4.95%.

Martwick’s bill would replace language in the Illinois Constitution, which currently states: “A tax on or measured by income shall be at a non-graduated rate. At any one time there may be no more than one such tax imposed by the State for State purposed on individuals and one such tax so imposed on corporations.”

Instead, under SJRCA 04, the state’s constitution would be changed to read: “The General Assembly shall provide by law for the rate or rates of any tax on or measured by income imposed by the State.”

In other words, the General Assembly would be permitted to impose multiple income tax rates on individuals or corporations. The legislation does not specify what these tax rates would be. The bill currently sits in the Illinois Senate Assignments Committee.

While the exact tax rates that may be enacted are to be determined, other bills currently active and previously proposed in the General Assembly have included specific income tax rates.

A similar constitutional amendment filed in the Illinois House, House Joint Resolution Constitutional Amendment 08, filed by state Rep. Curtis Tarver, D-Chicago, would allow for an additional 3% income tax to be applied to individuals’ incomes in excess of $1 million. The bill currently sits in the House Rules Committee.

In 2023, Martwick filed Senate Bill 2105, which would have created eight income tax brackets with tax rates ranging from 4% to 6.95%. For those who would have fallen into the top tax bracket – incomes of $500,000 or more for single filers and $1,000,000 or more for joint filers – the 6.95% tax would have applied to all of the taxpayer’s net income, resulting in a 40.4% increase in their income tax rate. Progressive taxes are usually imposed at lower rates on a taxpayer’s initial chunk of income with higher rates on each progressively higher income bracket. The bill never made it out of the Assignments committee.

In 2020, legislation passed in the General Assembly that would have created income tax brackets with tax rates ranging from 4.75% to 7.99%, dependent on voter approval of a constitutional amendment to remove the state’s flat income tax requirement. That was the “Fair Tax,” which voters soundly rejected in November 2020.

In 2018, another bill filed by Martwick would have created four income tax brackets, with tax rates ranging from 4% to 7.65%. The bill would have constituted an income tax hike for a vast majority of Illinois taxpayers, starting with individuals earning as little as $17,300 for a single filer with no dependents.

Illinois’ constitutional flat income tax requirement is a valuable protection for state taxpayers to ward off future tax hikes. Illinois is one of 23 states that has or is in the process of implementing a flat income tax – including those that impose no income tax, and one of only four states where the tax structure is protected in the state’s constitution. Every state that implements a progressive income tax also taxes retirement income, which is currently exempt from taxation in Illinois.

Illinois’ flat income tax rate structure is currently one of the few advantages in the state’s tax code that boosts the state’s competitiveness. Removing this constitutional protection would weaken barriers to tax hikes that state legislators currently must overcome to raise taxes. It would also be a move that bucks national trends toward lower, flatter taxes.

Lawmakers should preserve this barrier rather than open the door to future tax hikes.

= = = = =

Sign the petition against the proposal at the bottom of this article. I did. Signing will provide the contact information to allow you to help fight whatever the Democrats stick on the ballot next year.