From the Illinois Policy Institute:

Illinois’ top 50 state pensioners can expect an average lifetime payout of $8.47 million despite just $333,844 being contributed during their careers. That’s $1 in, $25 out, thanks to taxpayers.

It’s good to be in the top 50 of Illinois’ state pension plans: invest $333,844 and your average lifetime payout will be $8.47 million.

Where else can you get a $25 return on each buck invested?

The top 50 pensioners across the five statewide systems by benefits paid have already each received an average state pension worth about $5.63 million since retiring. They are predicted to each collect about $2.83 million more during their lifetimes to reach that $8.47 million total.

That $333,844 investment includes their payroll deductions and contributions by the government during their employment. They recouped that investment in 11 months at 2024 retirement benefit rates.

No wonder Illinois’ five statewide government pension systems are nearly $144 billion in the hole. And that might be a vast underestimate: ratings agencies have projected the pension debt at more than double the state’s estimate.

The Illinois Policy Institute article provides the top 50 pensioners,

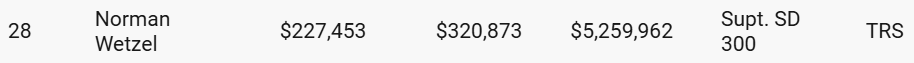

The only local one is former Carpentersville (now Algonquin) District 300 School Superintendent Norm Wetzel:

Among these top 50 state pensioners for benefits received, 33 were members of the State Universities Retirement System and the remaining 17 were annuitants of the Teachers Retirement System.