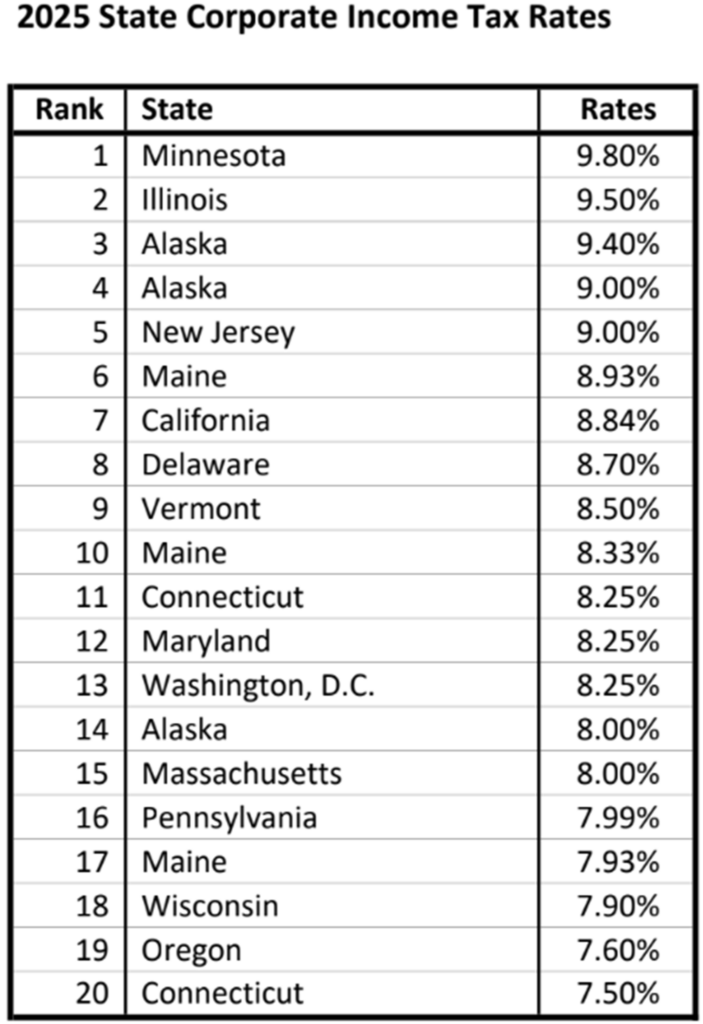

From the Tax Foundation, pulled out by a Friend of McHenry County Blog;

Why is the tax rate so high and how could have it have been lower?

This is a stunning revelation to me.

It has two components:

- 7% traditional Income Tax

- 2.5% Personal Property Replacement Tax

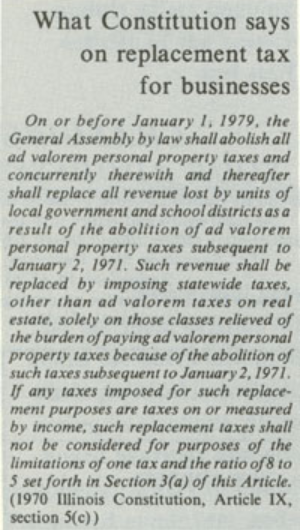

In 1970, voters amended the Constitution to abolish the Personal Property Tax on individuals.

That vote was the culmination of a campaign by County Treasurers to abolish the tax.

The reason?

County Treasurers were tasked with collecting the tax.

Some of us took it seriously, reasoning that stringent enforcement would put pressure on legislators to abolish it.

In Cook County, homeowners who received a Personal Property Tax took it to their Democratic Party Precinct Captain and he made it go away.

When people moved from Cook to McHenry County, many saw no reason to pay the tax.

My collection efforts consisted of suing every person who owed over $20. Often it took two years for the unpaid bill to reach that level.

My office filed about 2,000 small claims suits a year.

In McHenry Township, I sued one-quarter of the households.

So, what happened with the lawsuits?

No way for me to lose and virtually everyone sued, just ignored the suits.

The result was that the title company place a lien against the property, meaning they could not sell their homes without paying up.

That was the only way to get a clean title.

Other County Treasurers also enforced collection.

One, Victor Castle of Peoria County went further.

He seized cars of delinquents.

I went down to see his operation.

We knocked on the door of one trailer in East Peoria and ended up hiding behind a snowplow blade when the owner came out with a gun.

I decided that was not a route I wanted to take.

I did try a safer route.

I filed follow-up suits forcing people to come to court.

If they did not show up, my Assistant State’s Attorneys filed for body attachments.

The tax delinquent would be picked up by the Sheriff and brought in. They could easily end up spending a night in jail.

Needless to say, such folks were quite unhappy.

For some reason, Cook County State Rep. George Burditt introduced a bill requiring proof of Personal Property Tax payment in order to obtain license plates.

County Treasurers packed the small committee hearing room on the fifth floor of the House side of the Capitol and the bill got out of committee.

It passed the House, but not the Senate.

Our campaign, however, caught the attention of McHenry County State Senator Robert Coulson.

He introduced a constitutional amendment to abolish the Personal Property Tax on Individuals.

It was on the November 1970 ballot right before my term ended,

The voters passed the amendment.

But, left to subsequent legislators.

The replacement legislation was not passed until after I left office in January, 1981.

My idea for replacement was to take the amount lost in the year before the replacement tax was enacted and levy a tax rate that would raise that amount.

Then, in each successive year my suggestion would have been reducing the rate needed to bring in the same amount.

Instead, the statue kept the tax rate at 2.5%, thus extracting more money each year.

Had a flat amount been taxed, over time, the percentage charged corporations would decrease every year.