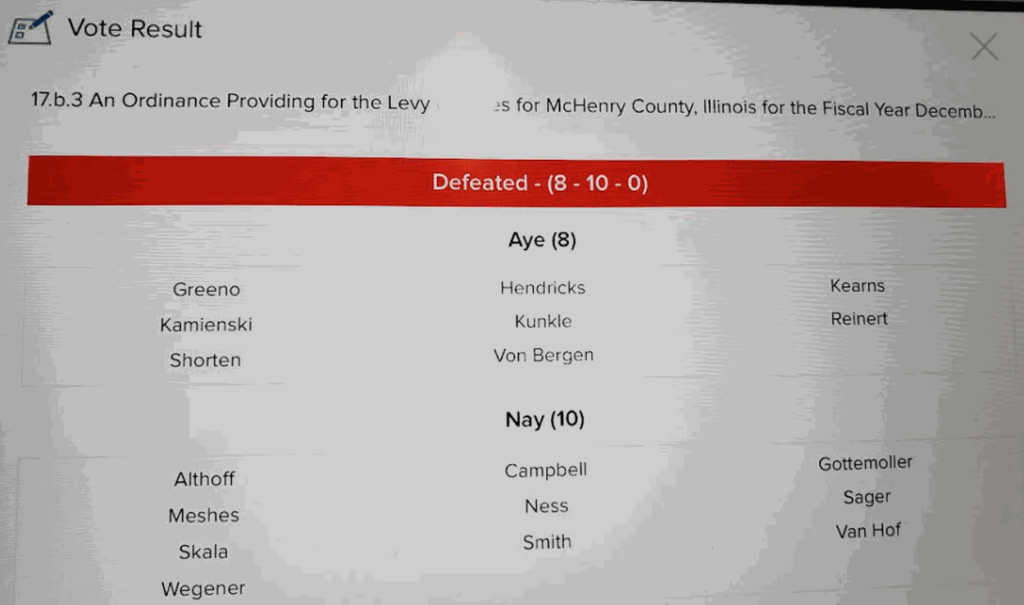

A representative of the “Flatliners” sent me the following vote total for the 1.95% property tax levy recommended by both McHenry County Administrator and the Finance Committee.

It was on the motion to reject the recommended tax hike, which failed 10-8.

I’m listing the results by name to make them searchable.

Those voting to hike taxes, the ten qualifying as Tax Eaters this year, include all Democrats and five Republicans not up for re-election:

- Pam Althoff (R)

- Carolyn Campbell (D) Finance Committee member

- Joe Gottemoeller (R)

- Theresa Meshes (D) Up for re-election next year, Finance Committee member

- Lou Ness (D) Up for re-election next year

- Brian Sager (R) Finance Committee member

- Mike Skala (R) Finance Committee Chairman

- Larry Smith (R) Finance Committee member

- Gloria Van Hof (D)

- Kellie Wegener (D) Candidate to replace Mike Buehler as County Board Chairman

Here are those who voted in opposition to both the almost 2% real estate tax levy increase and taking revenue from newly built property; all Republicans up for re-election voted on the side of the taxpayers.

- Terri Greeno (R) Finance Committee member

- Eric Hendricks (R) Up for re-election next year

- Carl Kamienski (R) Up for re-election next year

- Jim Kearns (R) Up for re-election next year

- Matt Kunkle (R)

- John Reinert (R) Up for re-election next year

- Mike Shorten (R) Up for re-election next year

- Tracie Von Bergen (R) Up for re-election next year

The vote to increase the levy was the reverse ten in favor, either opposed.

On May 1,’22 in an interview with the Northwest Herald,Kelli Wegner said this,

” It’s understandable that McHenry County residents are upset about their high property taxes, and I will do whatever I can to reduce their burden”.

Kamala Kelli strikes again!

Looks like maybe McHenry County should try elect Democrats like Kane County instead of RINOs.

I repeat here the comment I just posted under Mr. Skinner’s article regarding the Kane County brethren of McHenry County.

Those R’s who voted to increase shall be remembered in the voting booth and elsewhere.

An increase in the levied amount does not equate to a definitive tax spend increase for residents.

There has been an increase in the number of homes, business etc. so it’s possible that someone’s taxes actually could go down despite an increase in the levy.

Reach out to your township assessors and they’ll explain in detail.

Taxation or no taxation, McHenry County and its people have serious problems that are not being addressed.

Cultural problems need to be addressed.

Unfortunately, there are no quality, affordable public or private colleges or vocational training institutions or cultural resources in McHenry County, located where they are needed.

So-called “mental health services” are no substitute for the intentional planned development and growth of a quality healthy culture.

The voices of impoverished and low-income families & individuals from the rural areas and distressed cow towns & hamlets are not heard in the halls & chambers in the McHenry County Administration Building, because the poor, elderly, injured & disabled folks can’t get there.

The “dial-a-ride” Pace Bus McRide service does not operate during evenings, when the 7:00 pm County Board meetings are held. There is at present no option or accommodation to make it possible for a citizen resident to appear remotely, electronically.

Many folks are homebound due to physical or financial reasons, or simply live too far away to be able to participate in the County forum of public comment time at the regular County Board meetings.

Further more, even if a resident does move heaven-&-hell to get there, often at enormous cost, there is no guarantee that, even if one does manage to speak at public comment time to bring attention to a problem or request assistance, that anyone will follow up and connect with that person, so that important and pressing needs & problems get addressed.

When a person does speak out, but the problems are not attended to and are thus ignored, there is little incentive to return to try again and again.

This might not seem like a big deal to those who live in the eastern quadrants of the county, where there is better transportation and municipal resources.

But this can be severely debilitating in the western quadrants of the county, for persons without resources to overcome walls and barriers to improvement.

Yodeling from the far southwestern corner of Riley Township, from the south side of the I-90 tollway, for example, is not likely to be heard in the halls and meeting rooms in Woodstock.

And the folks in Crystal Lake & McHenry & Algonquin areas, would not likely care, anyway, even if the yodeling from Riley could be heard.

Democrats masquerading as Republicans do it every time.

People run as Republicans but do not support any of the party values.

New blood is needed in the McGOP.

Gottemoller and Althof were always RINO shills, much like McCoochieCoochieConchie and Reick.

Sager is a glamming queerio who was never a Republican.

Skala and Smith more reeking pieces of sh_t.

Van Hof who changed her name from Urch is a black antifa scut.

These people are toxic clowns who are trying to kill us!

:::::::::::::::::::::

The Israeli ethnic cleansing/genocide of Palestinians is right out in the open.

Consequently the absolute Israeli control of US Congress is also right out in the open.

Then there’s the concern that the Israeli genocide of Palestinians could escalate towards WW3 (Hezbollah > Iran > Russia > China) with the US is totally unprepared for this eventuality.

However, Israel couldn’t care less about US interests, and wants its Golem involved. Congress won’t do anything to stop it. They’ll follow instructions, repeat the talking points and charge right in – same as they did with Ukraine.

The existence of a golem is sometimes a mixed blessing. Golems are not intelligent, and if commanded to perform a task, they will perform the instructions literally. In many depictions, golems are inherently perfectly obedient. In its earliest known modern form, the Golem of Chełm became enormous and uncooperative. In one version of this story, the rabbi had to resort to trickery to deactivate it, whereupon it crumbled upon its creator and crushed him

Vile monsters raising taxes – all this does is it reveals they are CLUELESS to the realities of the struggles people are dealing with financially AND that they are dumbasses in terms of economic impact.

This will temporarily increase revenue and then dramatically decrease revenue for the area.

John Kennedy called it the “PARADOXICAL TRUTH”…..Tax revenue is too low because tax RATES are too high. Google his speech to the NYC Economic Club in 1963.

Althoff, Gottemoller, and Ness are too stupid, too vapid, too clueless of economics and history to realize the harm to everyone they have created.

Does anyone ask themselves…..hmmmm, why do we need to keep raising taxes?

When will we become fiscally sound – after all, this is the highest state in terms of taxation – next to NJ, NY, and California – the other states TANKING economically.

But, let’s keep up the policies that cause the failure.

DUMBASSES.

Look on the bright side Conservatives…

The vote is in.

No more hiding.

Now you know exactly what Tax Raising Son’s of Bitches to vote the Hell out of office.

“…..and wants its Golem involved.”

Is this our Golden Golem tRumpty?

“Golems are not intelligent……enormous and uncooperative……had to resort to trickery…it crumbled upon its creator(s) and crushed (us)

Threads of truth.

The county is taking new growth, plus 1.95% on current property owners.

If the Board had had a flat levy and not taken new growth, all of us would have seen a small tax cut.

Carolyn Campbell: biggest fraud on the noard, and that’s saying something!

Never trust a Campbell!

https://mapleleafmacgregor.ca/index.php/newsletters-pdfs/volume-5-issue-1-jan-2022/202-trust-a-campbell

Easy there,

I have a nephew-in-law who is a Campbell whose law school daughter just argued a case before a state apellate court.

Lower tax rates lead to HIGHER tax REVENUE.

No-one gets that “Paradoxical Truth”.

Everyone has inculcated an economic notion that is WRONG.

If I owned a burger joint that was struggling, RAISING the price of the burger will only DECREASE customers. Raising the price might work for a week or two….but then it fails – miserably.

Those who voted for the tax increase might as well have voted for this: “Am I an economic dumbass? Y or N?:”