Reprinted with permission:

Illinois’ Lethal Combination: Rising Property Taxes & Stagnant Incomes

A lethal combination of rising property taxes and stagnant incomes has forced many Illinoisans to rethink their relationship with their state.

More than 1.5 million net residents have already fled the state since 2000 – and you can’t blame others for thinking about joining them.

More than 1.5 million net residents have already fled the state since 2000 – and you can’t blame others for thinking about joining them.

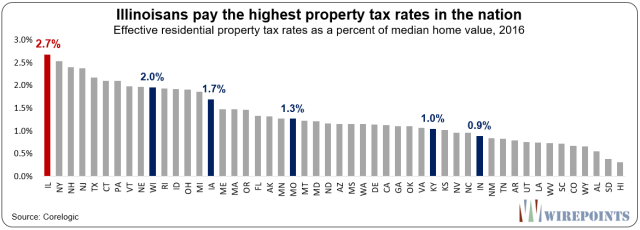

Property taxes have become punitive in Illinois.

We’ve written about how these taxes have destroyed the equity in people’s homes across the state.

Many families have done the math, and whether they’re in the struggling south suburbs of Chicago or the affluent North Shore, they’ve decided to leave Illinois behind.

That fact is outrageous on its own.

But to really understand the pain that these taxes inflict on Illinoisans, it’s important to compare property tax bills to household incomes.

After all, those bills are paid straight from people’s earnings.

The unfortunate reality is that Illinois incomes have been stagnant for years – and falling when you consider the impact of inflation.

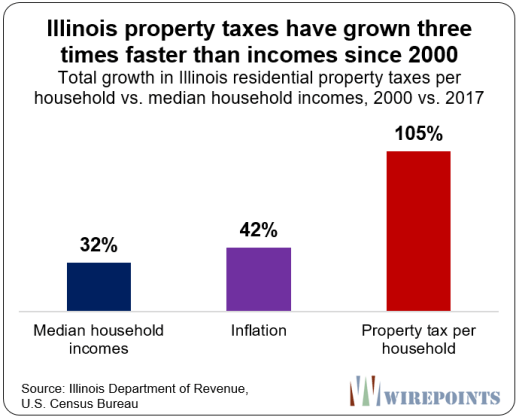

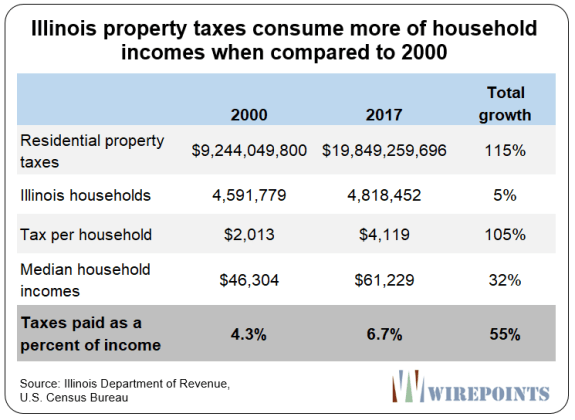

The net result: Property tax bills per household have grown three times faster than household incomes since 2000.

That means more of Illinoisans’ hard-earned incomes are going toward property taxes and less towards groceries, college tuition, and retirement savings.

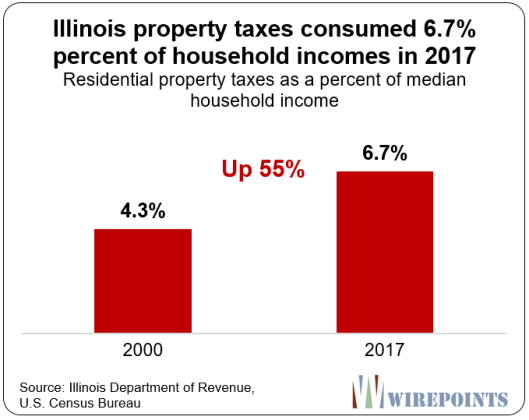

In 2017, 6.73 percent of household incomes went toward property taxes, up from 4.3 percent in 2000.

That’s a 55 percent increase in the effective tax rate.

The detailed data is below:

Property taxes, county by county.

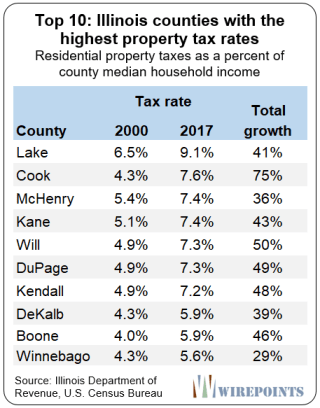

Residents of Lake County pay the highest property taxes in Illinois when measured as a percentage of household incomes.

In 2000, Lake County residents paid 6.5 percent of their household incomes toward property taxes.

Today, residents pay 9.1 percent.

That’s a 40 percent increase.

The average Lake County property tax bill is now over $7,500 per household.

Meanwhile the residents of the other collar counties and Cook pay more than 7 percent of their incomes to property taxes, with average bills ranging from $4,500 to $6,200 a year.

Overall, the collar counties pay the highest taxes as a percent of income in the state.

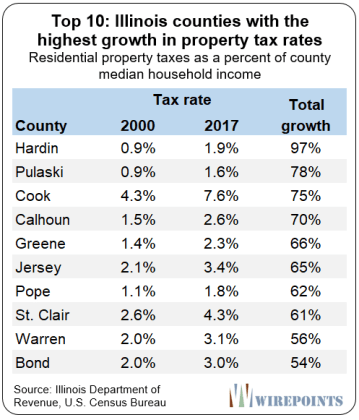

But it’s not just the Chicago suburbs that are taking a hit.

Taxpayers statewide have seen their taxes rise.

In fact, most of the counties that have had the biggest tax growth, in percentage terms, are found downstate.

Hardin County residents, though they pay low rates, have seen them jump 97 percent since 2000.

Residents in Pulaski County, have seen their rates go up by 78 percent.

Cook County comes next at 75 percent, but after that it’s all deep downstate again: Calhoun (70 percent), Greene (66 percent), Jersey (65 percent), and Pope County (62 percent).

Taxes too high

Any way you cut it, Illinoisans are being punished by property taxes.

That’s prompted some, including new Gov. J.B. Pritzker, to propose a reduction in property taxes by increasing income taxes.

But that would do Illinoisans no good.

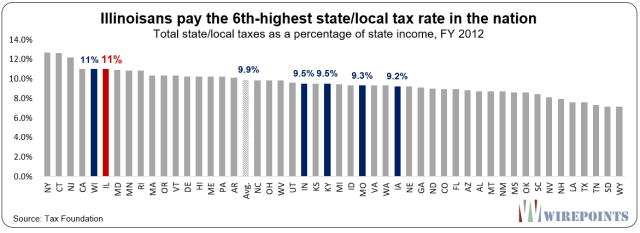

Illinoisans already pay the nation’s 6th-highest rates when you lump all state and local taxes together.

Shifting them around won’t help when the total tax bill is too high to begin with. What Illinoisans need is tax cut, not a tax shift.

Woodstock property tax rate FAR exceed that average.

A fairly assessed median value home in Woodstock Takes over 10% of median household income in property taxes.

Imagine the damage that does to local economy, and households’ economic security for the futures.

Woodstock TIF 2 will cause this crisis to be exacerbated.

Other states are able to charge less and still balance their budgets primarily because they use other types of taxes, such as income taxes, which may or may not be progressive, and higher sales taxes, liquor and cigarette taxes, and user fees.

These are fairer in that they are loosely tied to current incomes of the taxpayers.

If you are retired and/or on a fixed income, you are paying less or maybe nothing in state income taxes and are not buying much besides food and health related expenses.

However you are still paying property taxes, either directly or indirectly in the form of higher rents.

The inefficiencies of the state and the out of line pension benefits for state employees and teachers in Illinois plays a role, but fundamentally if you want to pay less in property taxes you have to agree to pay more in other types of taxes.

This would logically include a progressive state income tax.

You can’t have it both ways. Sorry.

Lower a tax by increasing a tax.

A shrewd Democrat solution.

Economist Priztker should call it The First Law of Bubble Butt Dynamics.

KE sidesteps the point: 10% of household income spent annually on property taxes is not able to be offset by a percentage point differential on state income tax, or a percentage point differential on the fraction of household income spent annually on sales- taxable goods and xervices.

But KE implies that Illinois makes up for its obscenely high property taxes with lower sales tax rates and lower income tax rates.

That is factually inaccurate.

Illinois does NOT have low sale’s taxes.

Sales taxes nearly 9%, 7th highest in America.

https://taxfoundation.org/state-and-local-sales-tax-rates-2018/

Illinois does NOT have low State income tax rates.

5% of income is not graduated so falls near the middle.

But it is important to note that most families do not earn salaries the equivalent price of a house every year, so a 1% tax rate differential on State income taxes would have only about 1/3 the impact on a median income household as the 1% differential higher property tax rate.

Approximately 70 percent of our real estate tax bills cover funding for school districts. Too many districts, bloated non-teacher administrative staffs, ridiculously high salaries and benefits and unrealistic pension promises are the problems. The entire school system, compensation, too high pension payments, pension colas, etc must be totally restructured, downsized, streamlined. A starting point is an amendment to the Illinois Constitution to eliminate colas.